Shimano sales worse than forecast as post-pandemic slump bites

First-quarter report reveals 16.8% revenue drop, annual operating income forecast adjusted down by 22 billion yen

The latest race content, interviews, features, reviews and expert buying guides, direct to your inbox!

You are now subscribed

Your newsletter sign-up was successful

As it predicted in its 2022 Q4 results published in February, Shimano has seen its sales "remain weak" in the first quarter of the 2023 financial year, resulting in a fall in global revenue compared to the same period last year.

The Japanese brand, whose markets primarily include cycling and fishing, revealed that its revenue from bicycle components fell 16.8% in the period January to March, dropping to 98.3 billion yen (£591m) from 118 billion yen (£710m) in the same period in 2022.

The report, published Tuesday, also revealed that the company's operating income fell to 22.1 billion yen (£133m) down from 32 billion yen (£195m) in the same period year over year.

The news was greeted harshly by the market, with Shimano's stock price dropping by nearly 12% across the day of trading on the Tokyo Stock Exchange.

Across the entire company, including both its bicycle and fishing tackle businesses, the brand is forecasting that its operating income will shrink by more than half to 83 billion yen (£498m) in 2023 compared to 2022. This is a significant drop from its prior estimate of 105 billion yen (£652m), which came during February's Q4 report, re-forecasting downward to the tune of 22 billion yen (£132m), and comes in the wake of a positive quarter for the brand's fishing division.

Despite the downturn, however, the brand's total and net assets remain stable, and the shareholders' equity ratio has increased by 1.5 percentage points, suggesting a slight reduction in debt.

"Although the strong interest in bicycles cooled down as progress was made toward recovery to pre-COVID-19 day-to-day routines, interest in bicycles continued as a long-term trend," Shimano said in its analysis, before adding "On the other hand, concerns about economic recession, including rapidly rising inflation, led to a slowdown in sales of completed bicycles, and market inventories generally remained high, despite ongoing supply and demand adjustments."

The latest race content, interviews, features, reviews and expert buying guides, direct to your inbox!

In Europe, the brand says that interest and retail sales of completed bicycles continued to be "solid," with e-bikes leading the way. Despite that, market inventories remained at "high levels," excluding some high-end models.

The North American market appears to be the most troubled, with Shimano stating that "sales remained weak and market inventories were at a consistently high level."

In Asian and South American markets, Shimano reports that sales are "sluggish" despite a "firm" interest in bicycles. It says this is due to currency depreciation and rising inflation, especially in Japan, where it says the depreciation of the Japanese yen has caused prices to soar.

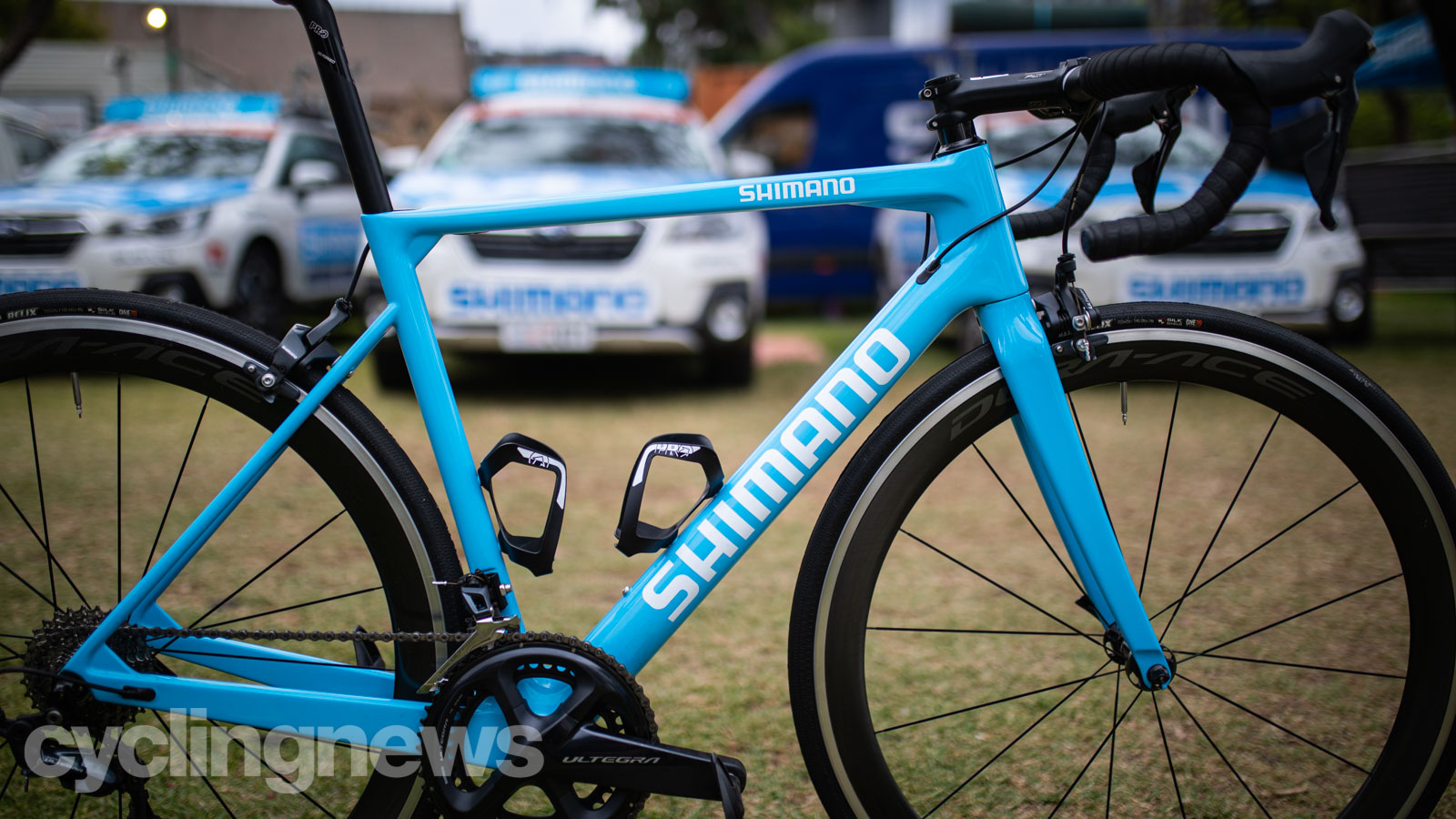

The brand also made the point of highlighting its launch of the 105 Di2 and STEPS e-bike drive unit as positive measures in weathering the current storm.

Josh is Associate Editor of Cyclingnews – leading our content on the best bikes, kit and the latest breaking tech stories from the pro peloton. He has been with us since the summer of 2019 and throughout that time he's covered everything from buyer's guides and deals to the latest tech news and reviews.

On the bike, Josh has been riding and racing for over 15 years. He started out racing cross country in his teens back when 26-inch wheels and triple chainsets were still mainstream, but he found favour in road racing in his early 20s, racing at a local and national level for Somerset-based Team Tor 2000. These days he rides indoors for convenience and fitness, and outdoors for fun on road, gravel, 'cross and cross-country bikes, the latter usually with his two dogs in tow.